Infinity the platform of choice

Specialist property insurance for many non-standard risks has been around for some time, but only Infinity brings these together in an easy-to-use, intuitive system with no need for manual intervention. Now that will make your life easier.

Discover the Ceta difference

Expertise

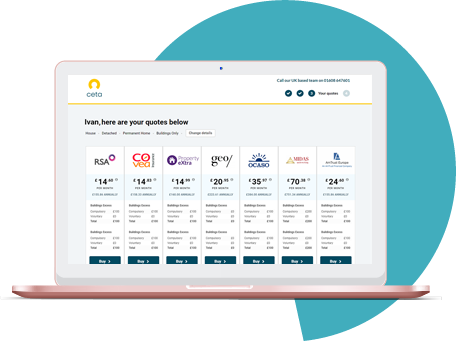

Our Infinity platform gives you the edge. Utilising state-of-the-art technology, you are able to quote, compare, click and bind more than 31 specialist risks online in less than two minutes.

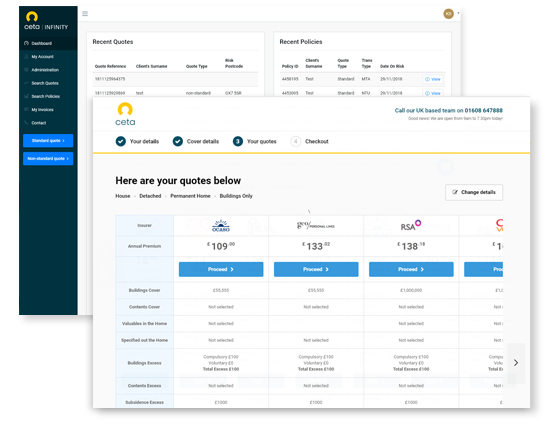

The Infinity platform is designed to do all the heavy lifting because we know you don't have time to be a subject matter expert in all aspects of property insurance. Consequently, the system will intuitively guide you through the process by asking relevant questions dynamically, tailored to your clients needs.

The Infinity system is quick and easy to use with an intuitive question set giving the broker access to a broad panel of leading providers in real time.

What's more, our Infinity platform not only delivers a rapid quote, it also provides you equally speedy support as standard. So, if you have any questions please get in touch with our team of on hand, dedicated staff.

Benefits of Infinity

No hidden agenda

As a straightforward company, we won’t impose unwieldy terms and conditions or set targets for minimum levels of business, that’s why we will continue to pay your commission for as long as the business stays on the books.

All under one roof

Everything you need to look after your clients needs is all available on the Infinity system, from a client dashboard through to all the legal and compliance documentation you need. At Ceta we design, build and run all of our own technology so you will never get handed off to a third party.

Rapid quotes, reassuringly fast

At Ceta we maintain an extensive panel of standard and non-standard insurers and we review this on a regular basis to ensure the best possible coverage. Infinity does all the heavy lifting so you and your clients won’t be subject to a long-winded, cumbersome referral process.

Trusted Partners